Answer:

The Annual rate of interest for the mortgage is 1.8%

Explanation:

Given as :

The mortgage principal = p = $167,000

The time period of mortgage = t = 20 years

The Amount paid towards mortgage in 20 years = A = $240,141

Let the Annual percentage rate on interest = r % compounded annually

Now, From Compound Interest method

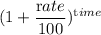

Amount = Principal ×

Or, A = p ×

Or, $240,141 = $167,000 ×

or,

=

=

Or , 1.437 =

Or,

=

=

or, 1.018 =

Or,

= 1.018 - 1

= 1.018 - 1

Or,

= 0.018

= 0.018

∴ r = 0.018 × 100

i.e r = 1.8

So, The rate of interest applied = r = 1.8 %

Hence, The Annual rate of interest for the mortgage is 1.8% Answer