Answer:

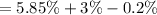

8.65%

Explanation:

Given information:

Recession Return = 13%

Normal Return = 6%

Boom Return = -4%

Probability of a recession = 45 %

Probability of a boom = 5 %

Probability of a normal = 100 - 45 - 5 = 50%

We need to find the expected rate of return on this stock.

Expected rate of return is the sum of products of probability and returns of each state of economy.

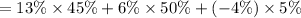

Expected rate of return

Therefore, the expected rate of return on this stock is 8.65%.