Answer:

8.00%

Step-by-step explanation:

Data provided in the question:

Selling price of the bond i.e current value = $270

Future value = $1,850

Maturity time, t = 25 years

Now,

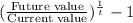

Effective yield to maturity, r =

on substituting the respective values, we get

Effective yield to maturity, r =

or

Effective yield to maturity, r = 1.0800 - 1

or

Effective yield to maturity = 0.0800

or

= 0.0800 × 100% = 8.00%