Answer:

Revenues in the order of 18.170,66 dollars per truck per year will break even financially the investment with a yield of 15%

for the 55 truck $999.386,66 per year

Step-by-step explanation:

F0 cash disbursement 21,200

MACRS dep dep tax shield (depreciation x tax rate)

7,065.96 1,766.49

9,423.40 2,355.85

3,139.72 784.93

1,570.92 392.73

annual cost of the truck:

20,000 x 0.45 x 5% increase per year

maintenance

first year 9000

second year: 9450

third year: 9922.5

fourth year: 10418.625

net (maintenance cost less tax shield):

net

7233.51

7094.15

9137.57

10025.895

Then, we bring this to present considering the discount rate:

time: 1 7,233.51 6,290.01

time: 2 7,094.15 7,094.15

time: 3 9,137.57 9,137.57

time: 4 10,025.90 10,025.90

Total PV 32,547.63

We know the salvage value in todays dollar is 35% of the purchase price:

21,200 x 35% = 7,420

(the inflation is already considered in the MARR)

We knwo calculate the present worth:

-21,200 - 32,547.63 + 7,420 = -38.907,63

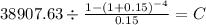

Know we solve for an annuity of four year to ge t the equivalent annual cost:

PV 38,908

time 4

rate 0.15

C $ 13,627.995

We have to consider taxes so:

13,628 / 0.75 = 18.170,66