Answer:

Explanation:

Given that X, the mutual fund returns in the 1st quarter of 2013, is

N(0.054, 0.015)

a) P(X>6.8%) =

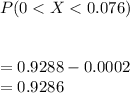

b)

c)

d)

A) The expected percentage of returns that are over 6.8% is _17.5_____%

b) The expected percentage of returns that are between 0& and 7.6% is __92.9__%

C) The expected percentage of returns that are more than 1% is _99.8___%

D) The expected percentage of returns that are less than 0% is _0.02___%