Answer:

Option 4: $2.18

Explanation:

Lets first analyse our given information. We know that:

- Original Cost Per Jug: $0.80

- Mark Up cost: 150%

- Sales Tax: 9%

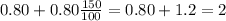

Now the Mark Up cost essentially means that the original price of any item has gone up (i.e. increased). So first let us find the Mark Up final cost of a $0.80 jug when price has increased by 150%, as follow:

Thus the jug after the mark up now costs $2.

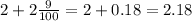

Now lets compute the sales tax on the final jug cost, thus the 9% Tax on $2 as follow:

So finally the total cost of a jug of iced tea from A-1 Deli is $2.18 dollars (i.e. Option 4).