Answer:

Arithmetic average rate of return = 9.30 %

geometric average annual rate of return = 8.58%

correct option is A 9.30 % and 8.58%

Step-by-step explanation:

given data

beginning share price = $50

time = 3 year

end year 1 prices = $62

end year 2 prices = $58

end year 3 prices = $64

to find out

arithmetic average annual rate of return and the geometric average annual rate of return

solution

we get here return for each period that is express as

Period 1 =

...........1

...........1

Period 1 =

Period 1 = 24%

and

Period 2 =

Period 2 = Period 1 =

Period 2 = -6.45%

and

Period 3 =

Period 3 =

Period 3 = 10.34%

so

here Arithmetic average rate of return will be

Arithmetic average rate of return = (24% + -6.45% + 10.34%) ÷ 3

Arithmetic average rate of return = 9.30%

and

geometric average annual rate of return will be here as

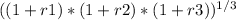

geometric average annual rate of return =

- 1 ................2

- 1 ................2

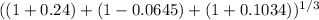

geometric average annual rate of return =

- 1

- 1

geometric average annual rate of return = 8.58%