Answer:

a: current value of the bond $405.11

b: Robison loss: 59.49%

c Pinson gain: 146.85%

As the investment is smaller the percentage change at maturity is greater than the difference in percentage of the par value.

A percent of the original investmentrepresent 10 dollars while !% of Mrs Pinson represent 4.05 dollars

Step-by-step explanation:

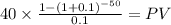

The present value of the bonds is the sum of the present value of the coupon payment and the maturity discounted at market rate:

C: 1,000 x 8% / 2 = 40.00

time: 25 years x 2 payment per year = 50

market rate 0.10

PV $396.5926

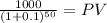

Maturity 1,000.00

time 50.00

rate 0.1

PV 8.52

PV c $396.5926

PV m $8.5186

Total $405.1111

Robinson capital loss:

405.1111/ 1,000 -1 = -59.49%

If purchased today and held to maturity by Mrs Pinson:

1,000 / 405.1111 - 1 = 146.85%