Answer:

yes, because the IRR is 12.74 percent

Step-by-step explanation:

given data

present value = $1.46 million

first year cash inflows c1 = $223,000

next three years cash inflows c2,c3,c4 = $600,000

rate of return minimum = 12 %

to find out

firm purchase this particular machine based on its IRR

solution

we consider here IRR is = r

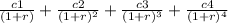

we apply here present value formula that is express as

present value =

.......1

.......1

put here value

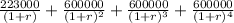

$1.46 million =

solve it we get

r = 12.74%

so here IRR = 12.74% is higher than the rate of return minimum = 12%

so it will create a positive net present value of cash inflows

and project will accepted and firm purchase the machine

so we can say yes, because the IRR is 12.74 percent