Answer:

8,031.94

Step-by-step explanation:

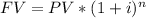

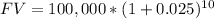

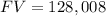

this problem can be solved first calculating the future value of the condo, so we can use the next formula:

where FV is future value, PV is the present value, i is the periodic interest rate and n is the number of periods. So applying to this particular problem we have:

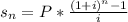

now we must apply the concept of annuity, keep in mind that an annuity is a formula which allows you to calculate the future value of future payments affected by an interest rate.by definition the future value of an annuity is given by:

where

is the future value of the annuity,

is the future value of the annuity,

is the interest rate for every period payment, n is the number of payments, and P is the regular amount paid. so:

is the interest rate for every period payment, n is the number of payments, and P is the regular amount paid. so:

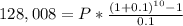

Solving P we have:

P=8,031.94