Answer:

$32,192,384.25 ; $32,148,352.96

Step-by-step explanation:

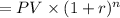

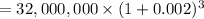

If invested in US ,

Value of Investment in $:

= $32,192,384.25

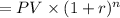

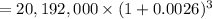

If invested in Great Britain ,

Amount to be invested in Great Britain:

= Present value × spot exchange rate

= $32,000,000 × 0.631

= $20,192,000

Value of Investment in Great Britain:

= $20,349,907.43

Value of Investment in $ when invested in Great Britain:

= Value of Investment in Great Britain ÷ Three-month forward rate

= $20,349,9707.43 ÷ 0.633

= $32,148,352.96