Answer:

To maximize return, A with 390000 and B with 210000

Explanation:

Given that a financier plans to invest up to $600,000 in two projects

Let x be the amount invested in 8% and y in 16%

Other information given is the investment in project B is riskier than the investment in project A, she has decided that the investment in project B should not exceed 35% of the total investment.

i,.e.

Also

The objective is to maximize interest function

subject to the above two constraints.

The corner points would be P(390000,210000) or Q(600000,0)

Calculate Z for these two points

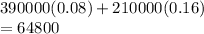

Profit at P =

Profit at Q =

So to maximize return, A with 390000 and B with 210000