Answer:

$222,100

Step-by-step explanation:

Cost = $837,300

Residual value = $84,000

Useful life = 9 years

Now,

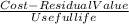

Annual straight line depreciation =

Annual straight line depreciation =

Annual straight line depreciation =

Annual straight line depreciation = $83,700

Accumulated depreciation for three years i.e., 2018, 2019 and 2020 would be:

Accumulated depreciation = 3 × $83,700

Accumulated depreciation = $251,100

Book value (at the end of year 2020) = Cost - Accumulated depreciation

Book value (at the end of year 2020) = $837,300 - $251,100

Book value (at the end of year 2020) = $586,200

Revised useful life = 5 years

No. years asset has been used = 3 years

Remaining useful life = 2 years

Revised salvage value = $142,000

Therefore, depreciation expense for the remaining three year would be:

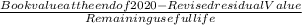

Revised depreciation expense =

Revised depreciation expense =

Revised depreciation expense =

Revised depreciation expense = $222,100