Answer:

annual net income is $23077.25

Step-by-step explanation:

Given data:

sales volume = 4200 units

selling price/units $50

variable cost/units $25

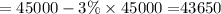

fixed cost is $45000

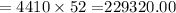

Total sales

selling price/unit

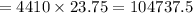

variable cost/unit

fixed cost

sales

variable cost

difference = 229320 - 104737 = 124583

fixed cost = $43650

depreciation exchange = $11000

so total income prior to tax = 124583 - (43650 + 11000) =$ 69932.5

tax rate is 33%

so total income after tax is