Answer:

$88.99

Step-by-step explanation:

First, find the Present value of the dividends;

The quarterly constant dividend of 1.55 for the 12 quarters is in form of an annuity, therefore, you can find its PV using a financial calculator with the following inputs;

Recurring payment ;PMT = 1.55

Total quarters; N= 12

Quarterly interest rate; I/Y = 12%/4 = 3%

Future one time payment; FV = 0

Then compute Present value ; CPT PV = 15.429

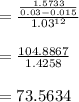

Find PV of terminal cashflow of the constant growing dividend;

Div 13 = Div12 (1+g) = 1.55(1.015) = 1.5733

PV (Div13 onwards)

Next, sum up the PVs to find the price of the stock;

= 15.429 + 73.5634

= $88.99