Answer:

maximum Current Price of Stock = $26.57

correct option is C. $26.57

Step-by-step explanation:

given data

dividend = $6 per share

increase the dividend = $1 per share

time = 4 year

return = 10 % = 0.1

to find out

How much are you willing to pay per share today to buy this stock

solution

we know that Current price we find dividend that is here

Year Dividend

1 (6+1) = $7

2 (7+1) = $8

3 (8+1) = $9

4 (9+1) = $10

so here current price by dividend and present value

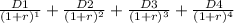

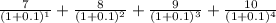

current price =

current price =

current price = $26.57

correct option is C. $26.57