Answer:

D. $156,000

Step-by-step explanation:

Cost = $400,000

Residual value = $10,000

Useful life = 5 years

Now,

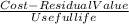

Annual straight line depreciation =

Annual straight line depreciation =

Annual straight line depreciation =

Annual straight line depreciation = $78,000

Annual depreciation expense is transferred to the accumulated depreciation. Thus, accumulated depreciation is sum of depreciation expense charged over the useful life of the asset.

Depreciation table has been constructed to compute the accumulated depreciation on 31st December 2017.