Answer:

3 times

Step-by-step explanation:

Financial Statements depicts the financial position of a firm at a particular point of time or specified date. The users of financial statements use various types of analysis to understand or compare the current financial statements of the company to prior years or with those of the competitors.

‘Ratio Analysis’ is used to analyze the performance of a company. It is used to analyze the liquidity, profitability, solvency and operational efficiency of the company.

Given:

Cost of goods sold = $255,000

Beginning inventory = $90,000

Ending inventory = $80,000

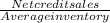

Inventory turnover is the ratio of cost of goods sold to inventory receivable.

It can be calculated as:

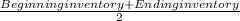

Average inventory =

Average inventory =

Average inventory =

Average inventory = $85,000

Inventory turnover ratio =

Inventory turnover ratio =

Inventory turnover ratio = 3 times