Answer:

Book Value

Step-by-step explanation:

Depreciation refers to fall in the value an asset as a result of normal wear and tear or due to efflux of time.

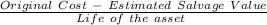

Depreciation is calculated using the following formula:

Depreciation expense per annum =

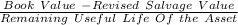

When, a company revises an estimate such as salvage value or remaining useful life of the asset, depreciation expense would be recomputed using the following formula:

Depreciation expense =

wherein, Book Value = Original Cost - Accumulated Depreciation till date