Answer:

$31.35 (Approx)

Step-by-step explanation:

Require a return on company's stock = 9.6%

Dividend:

Year 1 = $5.20

Year 2 = $9.30

Year 3 = $12.15

Year 4 = $13.90

Therefore,

Stock price:

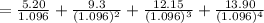

= Future dividends × Present value of discounting factor(rate%,time period)

= $31.35 (Approx)