Question:

Casey buys a bracelet. She pays for the bracelet and pays $0.72 in sales tax. The sales tax rate is 6%, percent. What is the original price of the bracelet, before tax?

Answer:

Original price of the bracelet before tax is $ 12

Solution:

Given that,

Casey pays $ 0.72 in sales tax

sales tax rate is 6 %

To find: original price of the bracelet, before tax

Let "a" be the original price of the bracelet before tax

Case has paid $ 0.72 in sales tax and sales tax rate is 6 % which means casey has paid 6 % of original price as sales tax rate

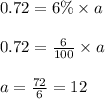

sales tax rate = 6 % of original price

sales tax rate = 6 % of "a"

Thus original price of the bracelet before tax is $ 12