Answer:

price of bond in 2023 = $9835.29

Step-by-step explanation:

given data

face value = $10,000

annual coupon rate = 4.5%

current interest rate = 6.25%

to find out

Calculate price at which you could sell your bond

solution

first we get here coupon payment that is express as

coupon payment = annual coupon rate × face value ......................1

put here value

coupon payment = 4.5% × 10000

coupon payment = 450

so here price of bond in 2023 will be

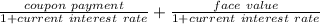

price of bond in 2023 =

..................2

..................2

put here value

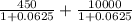

price of bond in 2023 =

price of bond in 2023 = $9835.29