Answer:

Stock price will be $16.8

So option (e) is the correct option

Step-by-step explanation:

We have f=given expected dividend

Required return

Growth rate = 0 % = 0.00

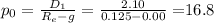

We have to find the stock price

Stock price is given by

So stock price will be $16.8

So option (e) is the correct answer