Answer:

Average expected rate of return is 3.13%

The asset have a zero rate of return if at price of $120

Step-by-step explanation:

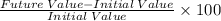

Rate of return RR =

Rate of return of the first possibility: (100-120)/120 * 100 = -16.67%

Rate of return of the second possibility: (115-120)/120 * 100 = -4.16%

Rate of return of the third possibility: (140-120)/120 * 100 = 16.67%

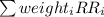

Average expected rate of return =

= 0.25*(-16.67%) + 0.25*(-4.16%) + 0.5*16.67% = 3.13%

RR = 0 => Future Value - Initial Value = 0

The asset have a zero rate of return when future price is the same as current price ($120)