Answer:

CAPM = 18%

FF3 = 20%

Step-by-step explanation:

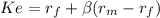

risk free 0,03

premium market= (market rate - risk free) = 0,1

beta(non diversifiable risk) 1,5

Ke 0,18000

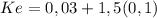

Fama-French Model:

We add another factors to the CAMP rate:

one for the size and one for the value of the company

CAMP + 0.5 x 0.04 + 0

As the value beta is zero then, that factor will be zero.

FF3 = 0.18 + 0.02 + 0 = 0.20