Answer:

A. $15,000

Step-by-step explanation:

Gross margin is the revenue from sales deducted by the production cost of goods sold.

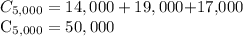

The total cost to produce all 5,000 units is:

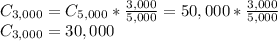

The production cost of the 3,000 units sold is:

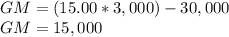

If each of the 3,000 units sells for $15.00, the gross margin for the first year is:

The correct alternative is A. $15,000

*Note that general, selling, and administrative expenses were not included since they don't qualify as production costs.