Answer:

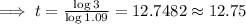

The correct option is d) 12.75

Step-by-step explanation:

Given,

The original price, P = $ 3.50,

Growth rate per year, r = 9.0% = 0.09,

So, the price after t years,

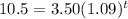

If A = 3P = 3(3.50) = 10.5,

Taking log both sides,

Hence, it will take 12.75 years for Ellis EPS to triple.

i.e. 'option d' is correct.