Answer:

Home Equity Loan is truly cheaper

Step-by-step explanation:

Data provided in the question:

APR of the loan taken = 6.9% = 0.069

Interest rate on Loan for boat per annum

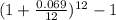

=

n = number of periods = 12 [when compounded monthly]

t = time = 1 year = 12 months

thus,

Annual Interest rate on Loan for boat =

= 7.12%

APR on home equity loan = 7.9% = 0.079

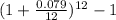

Annual Interest rate on Home Equity Loan =

= 8.51%

Tax saving on interest paid @ 25% = 0.25 × Annual Interest rate

= 0.25 × 8.51

= 2.1275% ≈ 2.13%

Therefore,

Total Interest cost on home equity loan

= Annual Interest rate - Tax saving on interest paid

= 8.51% - 2.13%

= 6.38%

Hence,

Home Equity Loan is truly cheaper