Answer:

Variable cost per unit = $64 per unit

so correct option is b. $64

Step-by-step explanation:

given data

sold Arks = 14,000 units

sold Bins = 56,000 units

products unit selling price unit variable cost unit contibution

Arks $120 $80 $40

Bins 80 60 20

to find out

Carter Co.'s variable cost

solution

we get here Variable cost per unit find as

Variable cost per unit = ( Arks unit variable cost × sold Arks + Bins unit variable cost × sold Bins ) ÷ total sales

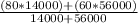

Variable cost per unit =

Variable cost per unit = $64 per unit

so correct option is b. $64