Answer:

correct option is b. $167

Step-by-step explanation:

given data

free cash flow FCF 1 = -$10 million

t = 1

free cash flow FCF 2= $20 million

t = 2

FCF grow rate = 4%

average cost of capital = 14%

to find out

what is the firm's value of operations

solution

first we get here firm value in year 2 that is express as

firm value in year 2 = expected FCF in 3 ÷ (cost of capital - growth) .........1

put here value

firm value in year 2 =

firm value in year 2 = 208 million

and

firm value of operation this year will be as

firm value = discounted value in year 2 + discounted FCF1 and FCF2 .............2

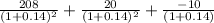

firm value =

firm value = 166.67 = 167 million

so correct option is b. $167