Answer:

the choice that would maximize the present value of your scholarship is receiving your scholarship in the amounts of $5,000 today and $5,000 next year.

Explanation:

Hello, I think I can help you with this

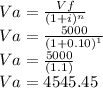

to solve this you must to find the present value in both cases, you can use this equation

where

Va= present value

Vf=final value

n=number of periods ( in this case 1 )

i=interest rate

Step 1

option 1

$5,000 today and $5,000 next year,it would be $5000 that you receive today, and $5000 next year, let's find the presente value of the last one pay

Let

Vf=5000

i=10%=0.1

n=1,(1 year)

put the values into the equation

the presente value will be

5000+4545.45= $9545.4545

you would have $9545.4545 today.

Step 2

option 2

with the second option you have $9000 today

$9545.4545 is greater than $9000

so, the choice that would maximize the present value of your scholarship is receiving your scholarship in the amounts of $5,000 today and $5,000 next year.

Have a great day