Answer:

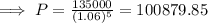

The company must invest $ 100,879.85 ( approx )

Step-by-step explanation:

Let P be the invested amount,

The annul rate, r = 6% = 0.06,

Number of years, t = 5 years,

Thus, the total amount after 5 years,

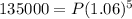

We have, A = $135,000,

( Using calculator )

( Using calculator )

Hence, company must invest $ 100,879.85 ( approx )