Answer:

The lump sum amount to be deposited should be $27,020.67

Step-by-step explanation:

Data provided in the question:

Future value = $60,000

Time, t = 10 years

Interest rate, r = 8% = 0.08

Compounded monthly i.e number of periods n = 12

Now,

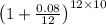

Future value = Amount deposited ×

Therefore,

on substituting the respective values, we get

$60,000 = Amount deposited ×

or

$60,000 = Amount deposited × ( 1.00667 )¹²⁰

or

$60,000 = Amount deposited × 2.220522

or

Amount deposited = $60,000 ÷ 2.220522

or

Amount deposited = $27,020.67

Hence,

The lump sum amount to be deposited should be $27,020.67