Answer:

c. $403.13

Explanation:

Cost of lawnmower = $328.61

Cost of lawn sprinkler = $13.27

Cost of hose reel = $27.96

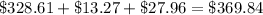

total cost of purchase without tax =

Taxes applied:

State tax = 5.5%

County tax = 1.5%

City tax = 2%

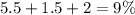

Total percent of taxes applies =

Amount added as tax =

⇒

⇒

⇒

Tax amount = $33.29

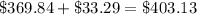

∴ Purchase price including tax = Cost price + Tax amount =

(Answer)

(Answer)