Answer:

$30.35

Step-by-step explanation:

We know,

Stock price,

=

=

Given,

= $0.8575

= $0.8575

Constant Growth Rate, g = 5.50% = 0.055

Required rate of return on the stock = 9% = 0.09

As we do not know the value of

, we have to find it through =

, we have to find it through =

x (1 + g)

x (1 + g)

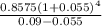

Putting the value in the stock price formula for third year

=

=

=

=

=

=

= $30.35

= $30.35