Answer:

(a) 1,078.12 copies

(b) 6.68 runs per year

(c) 37.43 days

(d) 10.78 days

(e) 767.62 copies

(f) $2,003.48

(g) 432 copies

Step-by-step explanation:

Given that,

Annual demand (D) = 7200 copies

Cost of the book (C) = $14.50

Holding cost (H) = 18% of cost of book = 18% of $14.50

= $2.61

Setup costs (S) = $150

Annual production volume = 25,000 copies

Number of working days = 250

Lead time (L) = 15 days

Daily demand (d) = Annual demand ÷ Number of working days

= 7200 ÷ 250

= 28.8 copies

Daily production (p) = Annual production ÷ Number of working days

= 25000 ÷ 250

= 100 copies

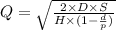

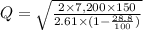

(a) Minimum cost production lot size (Q):

Q = 1,078.12 copies

(b) Number of production runs:

= Annual demand (D) ÷ Production quantity (Q)

= 7,200 ÷ 1,078.12

= 6.68 runs per year

(c) Cycle time:

= Production quantity (Q) ÷ Daily demand (d)

= 1,078.12 ÷ 28.8

= 37.43 days

(d) Length of a production run:

= Production quantity (Q) ÷ Daily production (p)

= 1,078.12 ÷ 100

= 10.78 days

(e) Maximum inventory (Imax):

= Q × (1 - d÷p)

= 1,078.12 × (1 - 28.8 ÷ 100)

= 767.62 copies

(f) Total annual cost:

= Annual holding cost + Annual setup cost

= [(Q ÷ 2) × H × (1 - d÷ p)] + [(D ÷ Q) × S]

= [(1,078.12 ÷ 2) × $2.61 × (1 - 28.8 ÷ 100)] + [(7,200 ÷ 1,078.12) × $150]

= $1,001.74 + $1,001.74

= $2,003.48

(g) Reorder point:

= Daily demand × Lead time

= 28.8 × 15

= 432 copies