Answer:

Earnings Per Share (EPS) = $1.18

Step-by-step explanation:

We know,

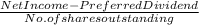

Earnings Per Share (EPS) =

Here,

Net Income = $2,500,000

Preferred Dividend = Total preferred stock in dollar x cost of preferred stock

Preferred Dividend = $5,000,000 x 8% = $400,000

No. of shares outstanding table is shown below (Weighted):

Shares outstanding + Additional shares - Treasury stock =

[750,000 x stock split] + [300,000 x (8/12) x stock split] - [150,000 x (5/12) x stock split]

= (750,000 x 2) + (200,000 x 2) - (62,500 x 2)

= 1,500,000 + 400,000 - 125,000

= 1,775,000

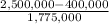

Now, EPS =

EPS = 1.18 (rounded to 2 decimal places)

Note: 1. As, there is a stock split of 2-for-1, that's why we multiply the stock by 2.

2. Since additional shares are issued on 1st May, therefore, the weight from May to December is for 8 months. Repurchased or Treasury stock should be removed from number of shares.