Answer:

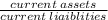

Current ratio: relationship between short-term assets and short-term liabilities

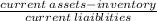

acid-test ratio it removes the inventory from the above calculation to check the presure to sale from the firm

(3)

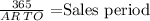

We first, solve for the accounts receivables turnover which is the times we collect the receivables and then, we divide over the days in a year to know the days outstanding

(4)

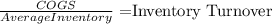

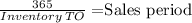

To calculate the times the inventory was sold during the period

(5)

We first, solve for the inventory turnover which is the times we sale the goods and then, we divide over the days in a year to know the days it takes to leave the inventory

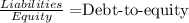

(6)

Relationship between own fund and borrowing

above one it means the company is leverage for third parties more than own fund

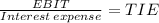

(7)

we make this division of the earning before interest and taxes against our interest expense.

This compares the operating income against the interest expense we got for borrowing below zero is a serious problem as the company falls to meet the interest of his debt

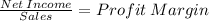

(8)

(9)

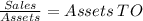

How the assets were managed to create sales for the firm

(10)

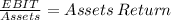

This will let us know how well we manage our assets as it link the income with the asset used to generated

(11)

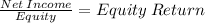

This will let us know how much we generate from the investment made.

Step-by-step explanation: