Answer:

before taxes 5.23%

after tax: 3.40%

Step-by-step explanation:

The bonds coupon interest rate is not the market rate . If Drogo Inc tries to take debt in the market it will be at a different rate as it is not selling at par.

We should determinate the market rate of the bond.

The bond sales as 97% which means the present value of the coupon payment and maturity discounted at the market rate equal 97% of the face value

We solve for this using excel and get:

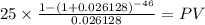

Present value of the coupon payments

C 25 (1,000 x 5% / 2 payment per year)

time 46 (23 years x 2 payment)

rate 0.026128

PV $664.7027

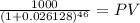

Present value

Maturity 1,000.00

time 46.00

rate 0.026128

PV 305.30

PV coupon $664.7027 + PV maturity $305.2973 = $970.0000

We know have to multiply this rate by 2 as it is semiannual like the payment:

0.026128 * 2 = 0.0523 = 5.23%

Last we calcualte the after tax cost of debt:

0.0523 (1 - 0.35) = 0.033995 = 3.40%