Answer:

B. 30%

Step-by-step explanation:

Initial value (Vi) = $120

Final value (Vf) = $150

Dividends paid (D) = $6

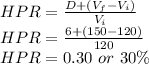

The holding period return is defined as the change in value during the year added to the dividends paid and then divided by the initial value:

The stock's annualized holding period return is 30%.