Answer:

D. $93,940.85

Step-by-step explanation:

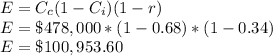

Cash inflows (Ci) = $478,000

Cash costs (Cc) = 0.68 of Ci

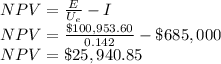

Initial investment (I) = $685,000

Tax rate (r) = 0.34

Unlevered cost of equity (Ue) = 0.142

Amount financed with cost of debt (D) = $200,000

Earnings after taxes (E) are given by:

Net present value is given by the earnings adjusted by the unlevered cost of equity minus the initial investment:

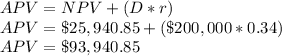

The adjusted present value (APV) is given by the NPV added to the present value of the cost of debt financing: