Answer:

pretax cost of debt: 6.633%

Step-by-step explanation:

We have to solve for the interest rate at which the present value of the coupon payment and maturity matches the present value of the bonds.

This is done using excelor a financial calculation

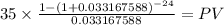

Present value of the coupon payment (ordinary annuity)

C 35 (1,000 x 7% / 2 payment per year)

time 24 ( 12 years x 2 payment per year)

rate 0.033167588

PV $573.0155

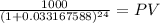

Present value of maturity (lump sum)

Maturity 1,000.00

time 24.00

rate 0.033167588

PV 456.98

PV c $573.0155

PV m $456.9845

Total $1,030.0000

Notice this rate is given with semianual payment we should multiply by two to get the annual cost of debt:

0.033167588 x 2 = 0.06633