Answer:

26.5, 14.344

Explanation:

given that you find a certain stock that had returns of 9 percent, −16 percent, 18 percent, and 14 percent for four of the last five years. The average return of the stock over this period was 10.3 percent,

Let the missing return in the 5 years be x

Then we get total of all five years

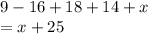

=

This will also be equal to the given average multiplied by 5

=

Equate both to get an equation in X as

Missing year return =26.5

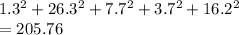

Variance = sum of (x-10.3)^2

=

Std dev= 14.344