Answer:

option (B) 9.10%

Step-by-step explanation:

Data provided in the question:

Total market value of a company’s stock = $650 million

Total market value of the company’s debt = $150 million

Cost of Equity, ke = 10% = 0.10

Cost of Debt, kd = 8% = 0.08

Corporate tax rate, T = 35%

Now,

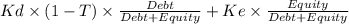

WACC =

on substituting the respective value, we get

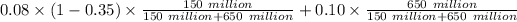

WACC =

= 0.08 × 0.65 × 0.1875 + 0.10 × 0.8125

= 0.00975 + 0.08125

= 0.091

or

= 0.091 × 100% = 9.10%

Hence,

The correct answer is option (B) 9.10%