Answer: We will reject the null hypothesis and it is true that more than 50% of U.S tax returns were filled electronically last year.

Explanation:

Since we have given that

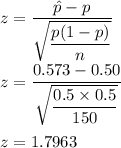

Here, p = 0.5

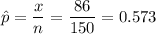

n = 150

x = 86

so,

So, test statistic value would be

At 5% level of significance, z = 1.645

So, 1.645<1.7963

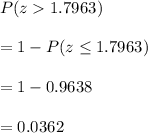

Hence, we will reject the null hypothesis.

P-value would be

Hence, we will reject the null hypothesis and it is true that more than 50% of U.S tax returns were filled electronically last year.