Answer:

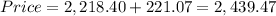

a) The present value of the bond is $2,439.47

b) If the coupon of the bond changes to 6%, the present value of the bond would be $960.53

Step-by-step explanation:

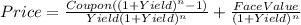

Hi, in order to answer the questions, we need to use the following formula.

Where:

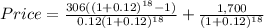

Coupon = 0.18*$1,700= $306

Yield = Discount rate (in our case, 12% or 0.12)

n = years to maturity (in our case, 18)

Face Value = $1,700

So, to find the price of the bond today, everything should look like this:

Therefore, the price is $2,439.47

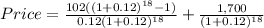

Using the same equation, the answer to b) is

The answer to b) is $960.53

Best of luck.