Answer:

The correct option is d. $ 785

Explanation:

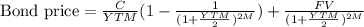

Since,

Where,

C = Annual coupon payment,

FV = Face value,

M = Maturity in years,

YTM = yield to maturity,

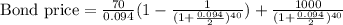

Here,

FV = $ 1,000,

C = 7% of 1000 =

= 70,

= 70,

M = 20 years,

YTM = 9.4% = 0.094,

By substituting the values,

= $ 785.3454 ( Using calculator )

≈ $ 785

Hence, OPTION d. is correct.