Answer:

c. credit to Sales Revenue for $72,380.

Step-by-step explanation:

Since AAA Car Repair's total purchases exceed $200,000 for the year, they are eligible for the 3% rebate on purchases above $60,000. Only the fraction of the purchase over $60,000 should get the 3% rebate, the first $60,000 get the 2% rate.

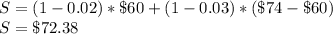

Therefore, the total sales amount recorded by P & G Auto Parts by selling $74,000 of parts to AAA is:

There should be a credit to Sales Revenue for $72,380.