Answer:

all transaciton made at the moment the lease begins.

lease receivables 200,001.13 debit

sales revenues 200,001.13 credit

cost of good sold 160,000 debit

inventory 160,000 credit

cash 35,013 debit

lease receivables 35,013 credit

Step-by-step explanation:

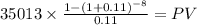

Present value of the lease payments

C 35,013.00

time 8

rate 0.11

PV $200,001.1278

The company will delcare this interest receivables and recognize the sales reveneue

It will also recognize the cost of good sold and decrease in inventory (it is equipment for the lessee but inventory for the lessor)

Then for each payment will recognzie a portion of interest revenue and decrease the lease receivables As the payment is at the beginning there is not interest revenue