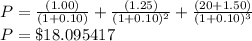

Answer:

$18.095417

Step-by-step explanation:

To obtain the current stock price, bring all paid dividends and the stock selling price to present value at a 10% rate per year:

*Note that for the dividends paid after the first year, only one period was considered, and for the dividends paid after the second year, only two periods were considered.

The stock price is $18.095417